By Jeff Bailey, CRO

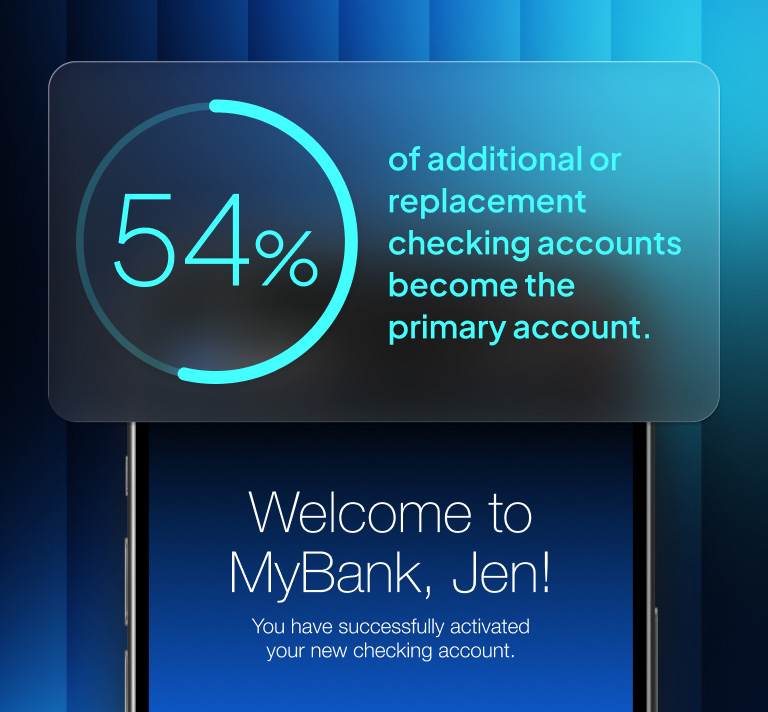

As the Chief Revenue Officer at Pinwheel, I speak to executives from the world’s top banks every day and I see first hand how rapidly the financial services industry is changing. With approximately 94% of the U.S. population holding bank accounts and a staggering 13 million new accounts opened in 2022, the competitive quest for primacy, or being the primary account for a customer, is more intense than ever. That’s why digital advertising spend is on track to close out 2023 by surpassing $30 billion.

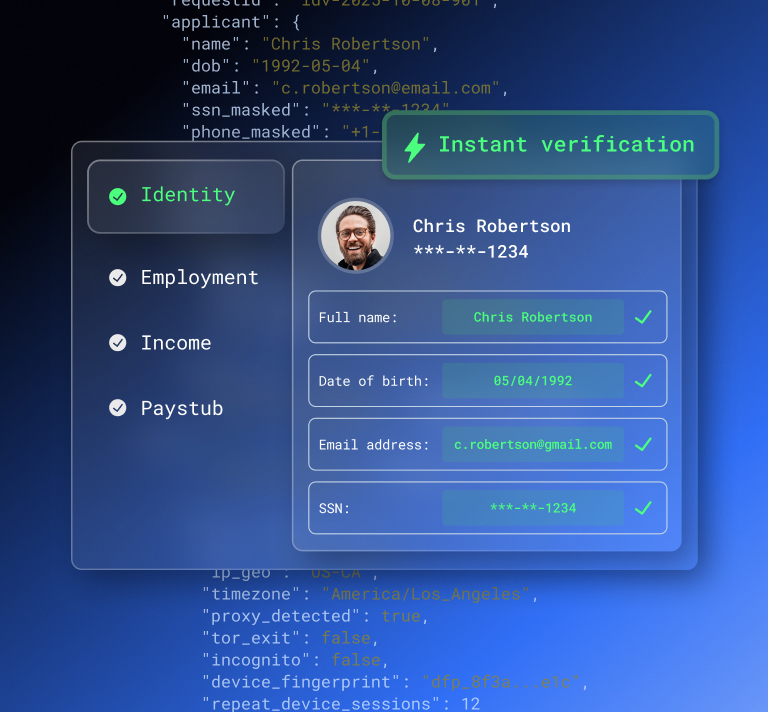

At Pinwheel, we help our customers extend their focus beyond the application to solve customer adoption challenges that could otherwise prevent them from maximizing the lifetime value (LTV) of each new user. We understand that acquiring a new customer is just the beginning of the journey and we are committed to helping banks chart a course to true primacy.

Understanding the primacy conundrum

In a world where the average consumer holds 5.3 bank accounts and possesses an average of 4 credit cards, the challenge for banks is clear. It's not just about attracting customers; it's about developing profitable relationships by becoming their primary bank. Achieving primacy means becoming the core of a customer’s financial life, which is typically signaled by direct deposits and everyday spending.

We've observed a common sentiment among our bank partners – confidence in their top-of-funnel acquisition campaigns, but uncertainty over the subsequent steps required to convert a prospect into an active, engaged customer. Banks can no longer declare victory after a successful account application. For many, an approved application is merely the starting line from which the competition to win primacy kicks off.

The must win battles

To solve the primacy puzzle we’ve developed a multifaceted strategy that encompasses customer satisfaction, understanding reasons for churn, and optimizing the return on investment (ROI) of marketing campaigns. Pinwheel strives to empower banks to overcome the hurdles that hinder seamless customer activation and engagement. Imagine a world where a customer could get an account number and have the account funded instantly?

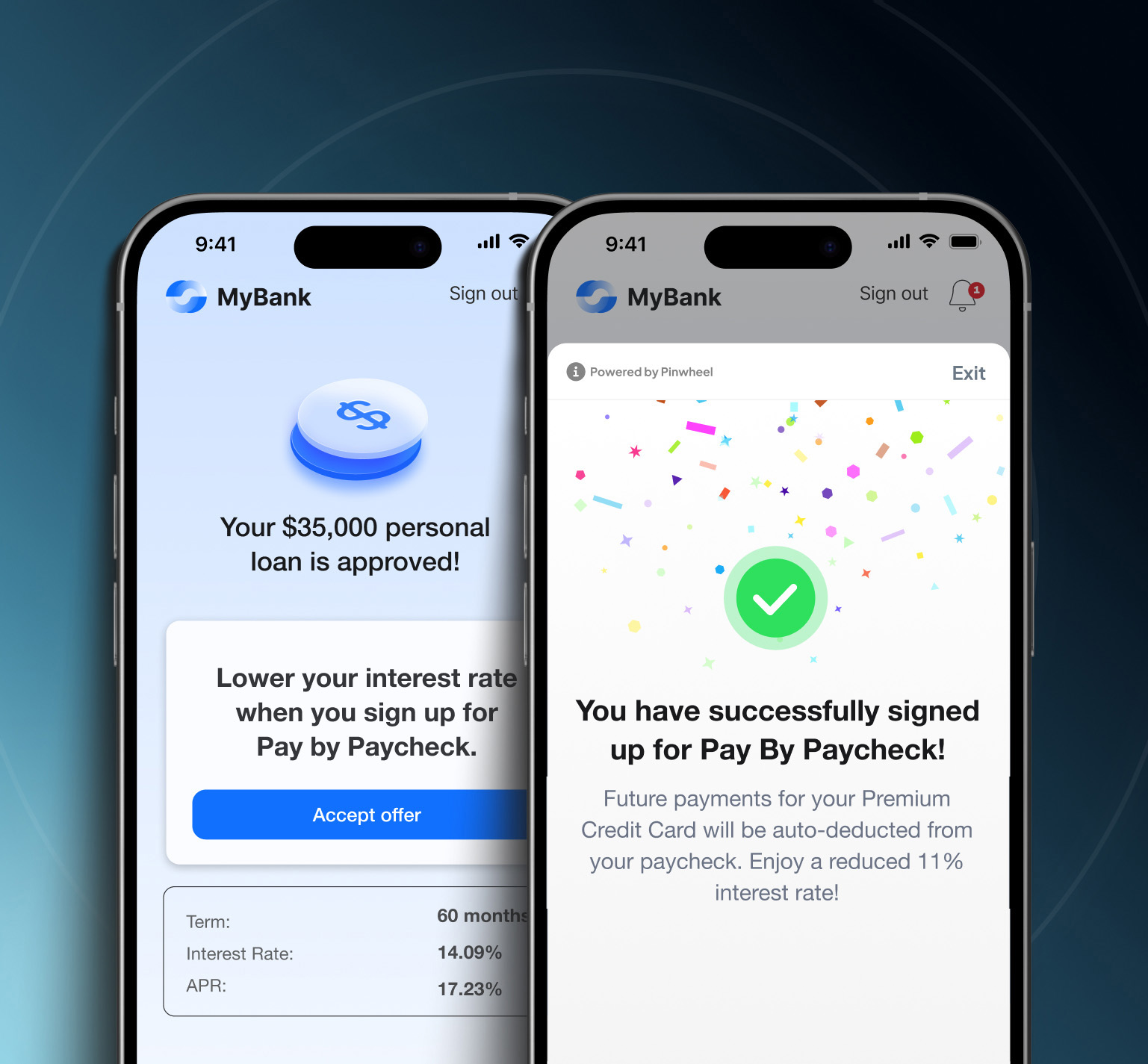

A noteworthy consideration for the future is the possibility of providing customers with instant incentives, eliminating the waiting period for direct deposits to hit their accounts. Pinwheel envisions a scenario where, instead of waiting for the next pay cycle, customers could receive immediate checking account incentives. This instant gratification could reshape customer behavior, increasing the likelihood of them choosing a specific bank or credit card as their primary financial tool.

One challenge frequently mentioned by our banking partners is the transition from initial acquisition to active customer status. The ability to set behavior immediately, as we consistently hear from our partners, is a potent force in the quest for primacy. By offering immediate incentives for customers to choose a specific bank or credit card as their primary financial provider, we can influence their decision-making process and cement long-term loyalty.

Here are various ways that we’ve found to be critical in winning the customer.

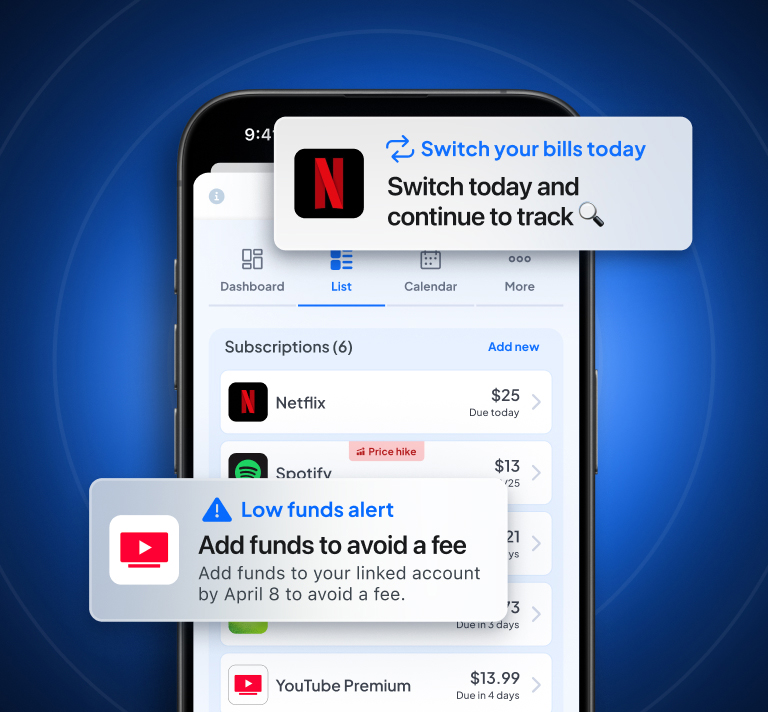

Speed: I’ve talked to executives at five of the largest financial institutions this week, and all of them agree that customer behavior gets set at the start of the relationship. This means the first 45 days are critical to converting sticky prime behaviors. Tactics to move your customer toward these behaviors faster include first funding of the account and setting up recurring funding through direct deposit. This can be done through a mix of user experience optimizations and marketing strategies.

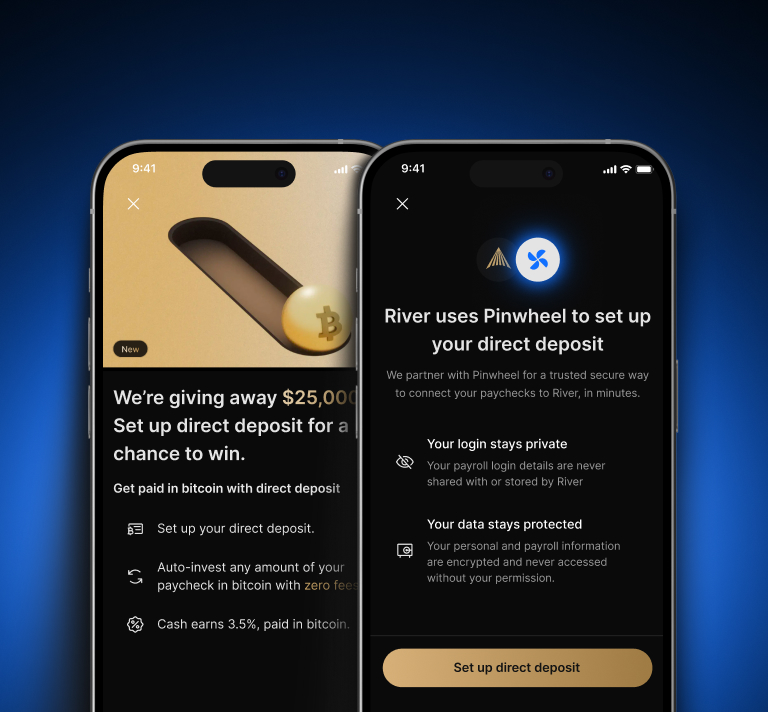

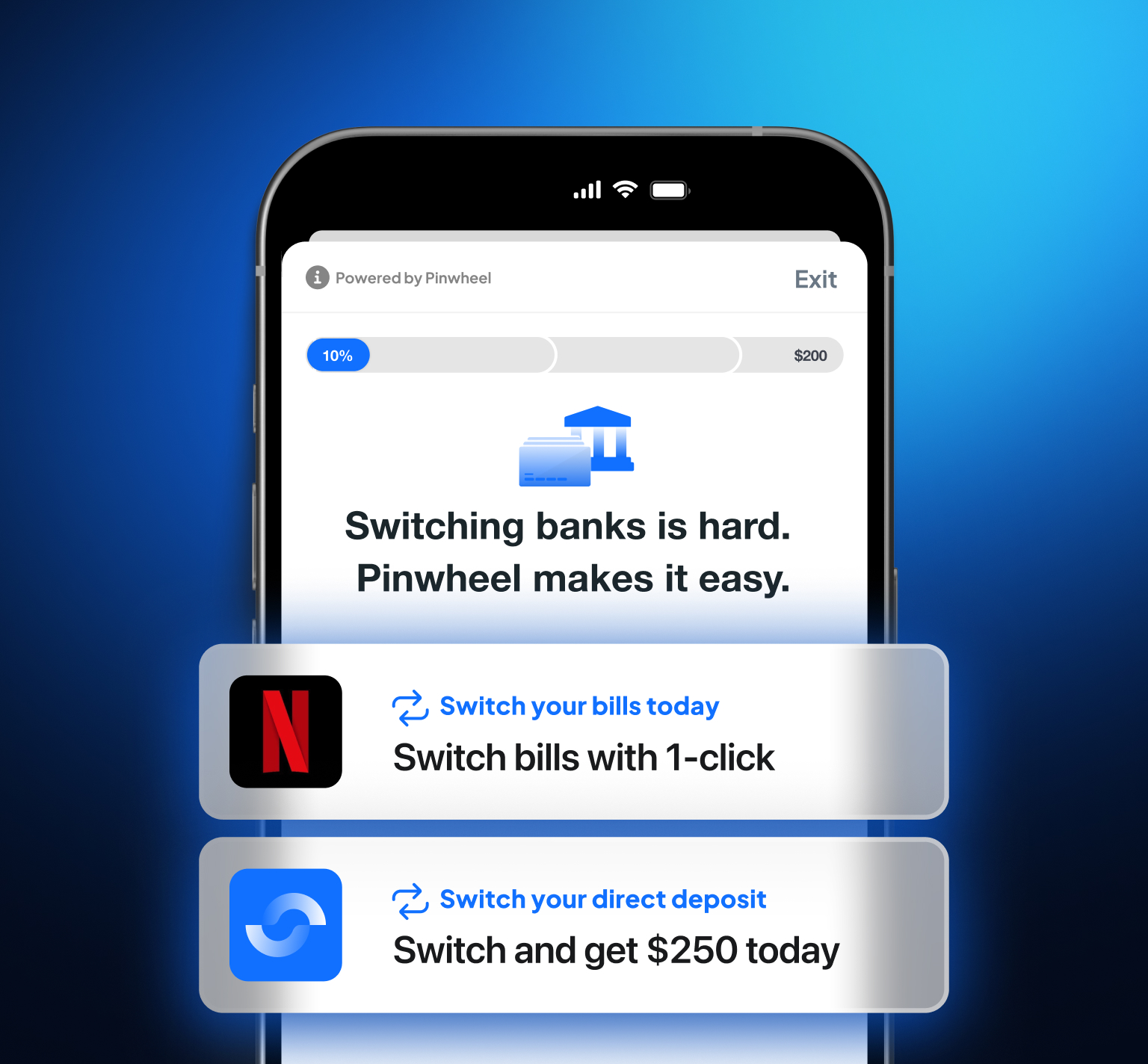

Deposit Incentives: Where a consumer decides to send their direct deposit (DD) has a huge impact on primacy. A DD is the lifeblood of any consumer’s financial life. Historically, the enrollment process for this has been a significant detractor due to clunky forms and a time consuming, multi-step process. Pinwheel was born to solve this critical user experience breakdown in the conversion journey, and now offers two best-in-class, fully automated DDS solutions. If you haven’t already, take a moment to learn about our groundbreaking and completely friction-free next generation product, which was just released to beta last week. An exceptional experience, just-in-time marketing, and promotions all should be deployed to aggressively pursue primacy goals.

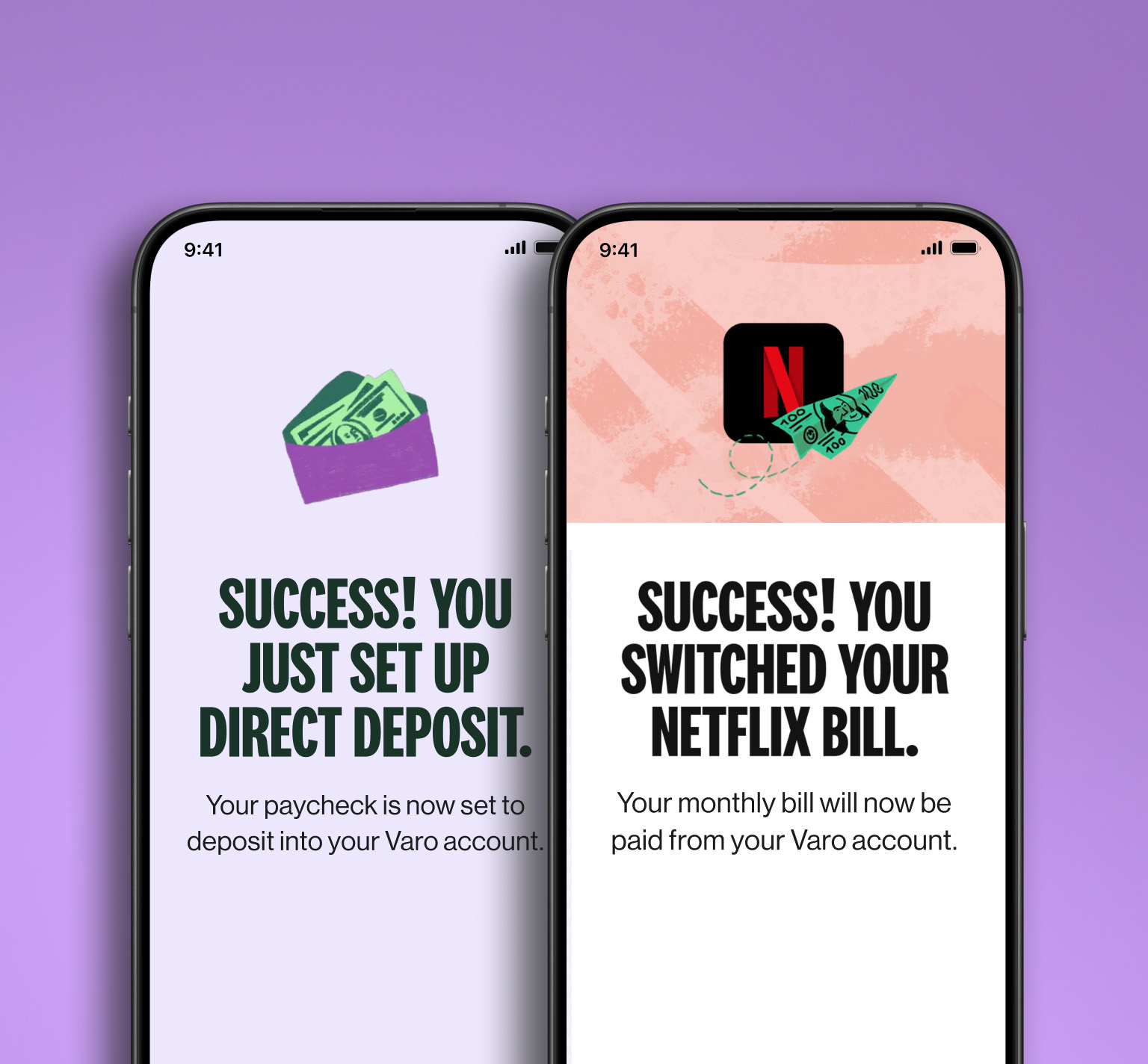

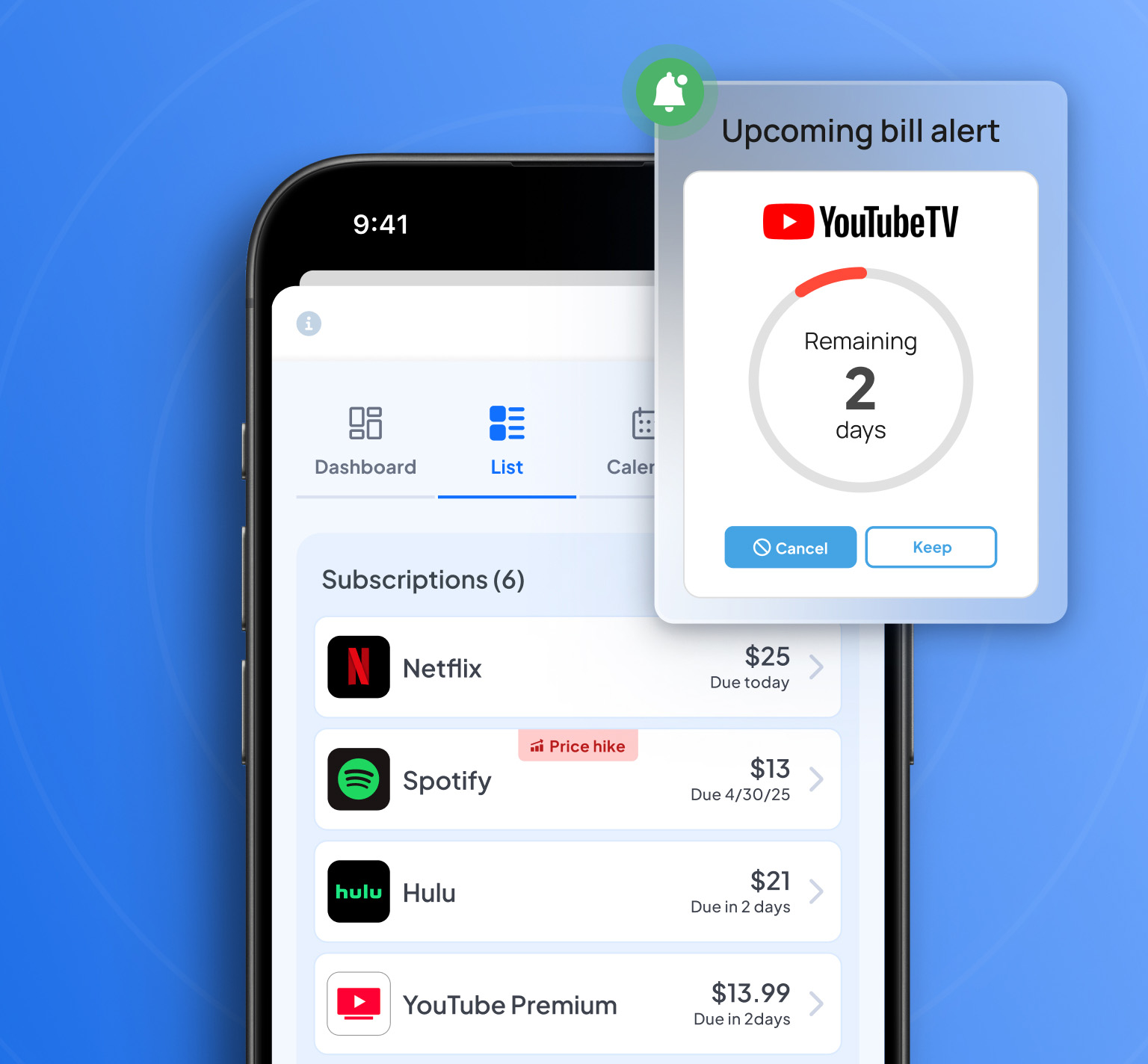

Sticky payment behaviors: We’ve focused on funds going in so far, but funds leaving the account is important as well. Prime bank accounts are littered with evidence of recurring every day payments required to support one’s life. Encouraging a new customer to switch their utility bill and other foundational life expenses to automatic payments are winning strategies to establish primacy.

Looking ahead

My vision for 2024 revolves around empowering banks to not only attract new customers, but to guide them seamlessly toward becoming active, engaged, and loyal clients. The evolving landscape of the financial services industry demands innovation, and Pinwheel is committed to leading the way in unlocking the full potential of customer lifetime value. With a focus on primacy, customer satisfaction, and real-time data, we aim to navigate the competitive landscape, ensuring our partners thrive in an era where every interaction is an opportunity to secure a lasting relationship with their customers.

.svg)

.svg)