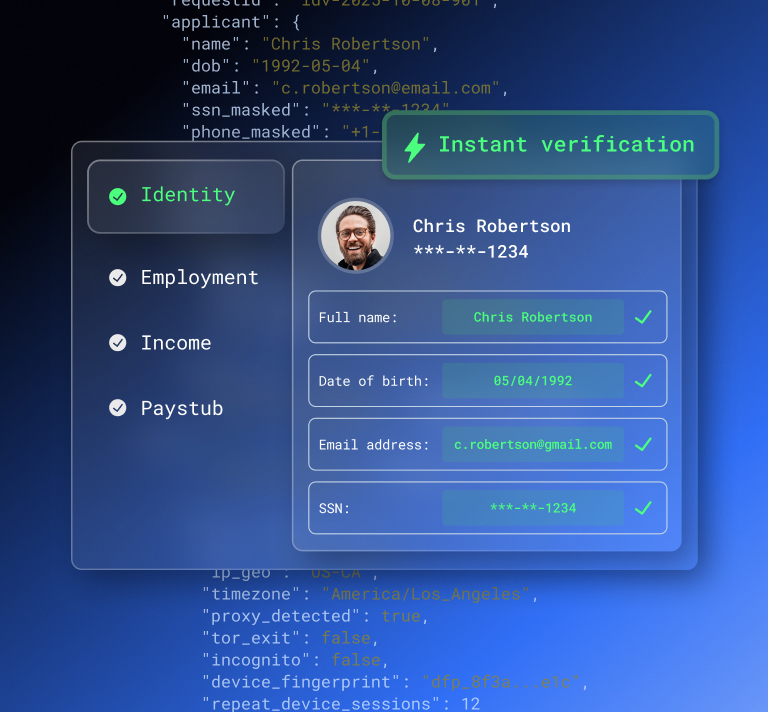

Whether you’re a landlord or a lender, income and employment verification is key to assessing an applicant’s risk. But the process can be time-consuming and filled with paperwork — not to mention prone to fraud.

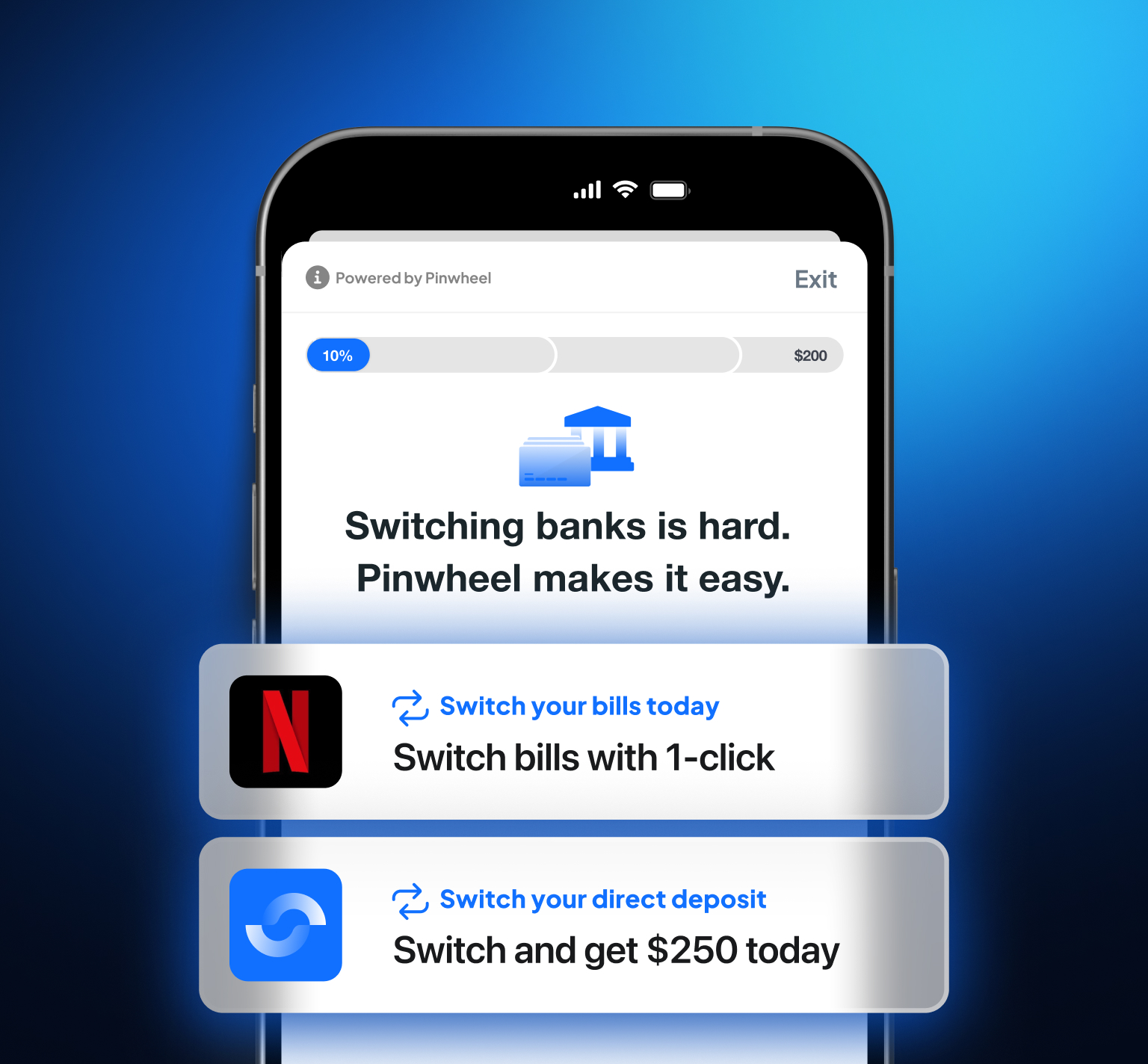

A payroll API can guarantee information accuracy and simplify the process of income and employment verification. In just a few steps, the consumer grants the API provider access to their payroll or income portal, and it returns data that can verify things like identity, employment, and income.

This data is invaluable to approve someone for a loan or a lease. Landlords can select future tenants based on a more comprehensive financial history and avoid accepting fake pay stubs. Lenders are able to expand their pool of serviceable consumers to consumers without good credit, as long as they have a steady income.

And most importantly, low-income consumers can access fairer financial services that don’t take advantage of their lack of options.

Expand access to better loans

With a payroll API, lenders can approve loans for a broader group of consumers — not just those with a high credit score. Almost 106 million Americans are credit invisible, conventionally unscorable, or have a poor credit score. Black and Hispanic consumers are more likely to be credit invisible, making it difficult for them to access loans at good rates. The unfortunate alternative is payday loans, which have an average APR of nearly 400%.

It’s no surprise that consumers who take out payday loans often fall into a debt trap, taking out new loans to make their repayments. It creates a vicious cycle that in no way helps consumers gain financial independence and might even lead to bankruptcy. To create a financially equitable system, we need to improve loan underwriting models.

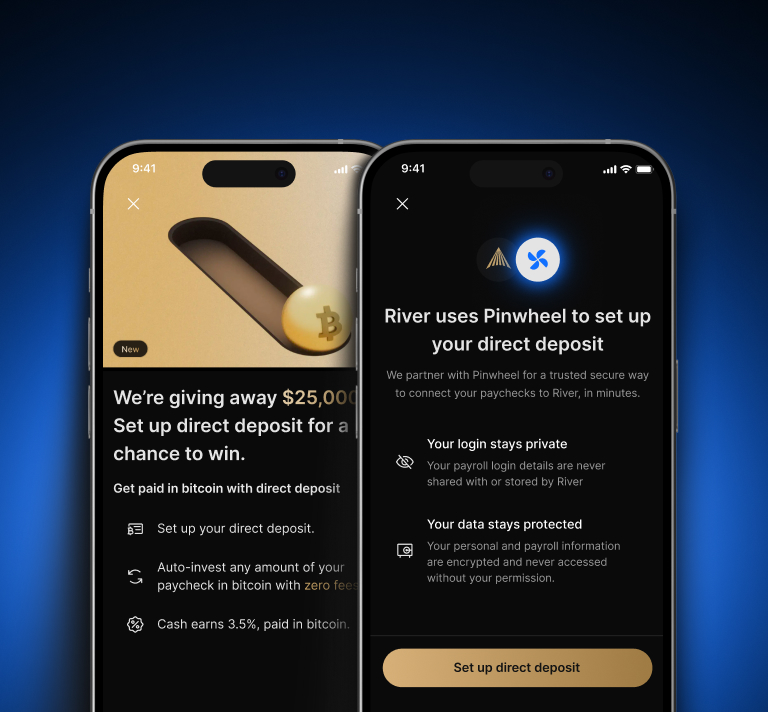

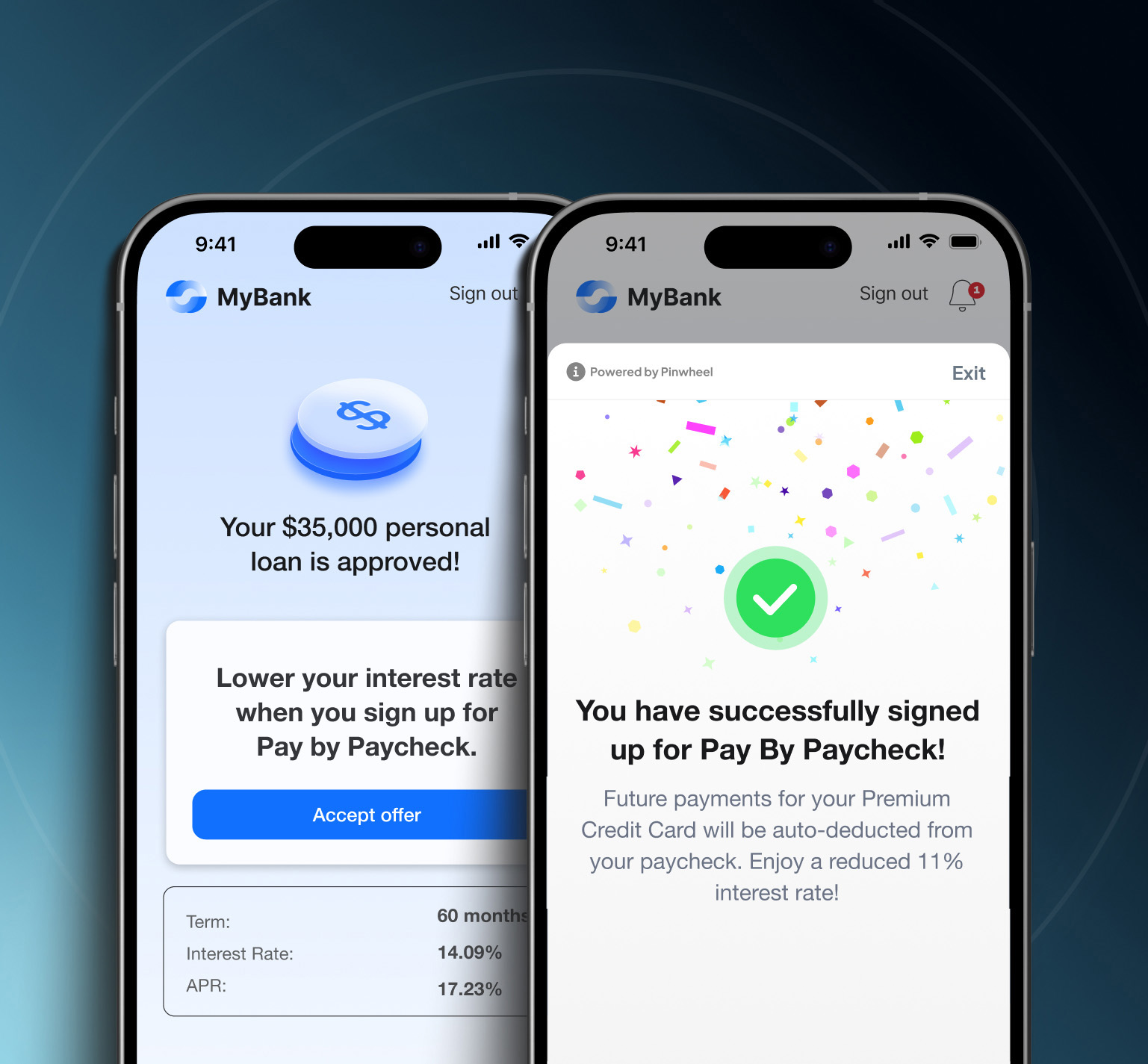

Pinwheel’s payroll API allows lenders to quickly verify an applicant’s income and employment with information that includes their identity, salary or hourly wage, and how long they have been employed. With this information, a lender can see that an applicant has a steady job and their salary is sufficient to repay the loan. Even if the applicant’s credit score is non-existent, the payroll data provides a wealth of insight into their financial health, which improves the underwriting process.

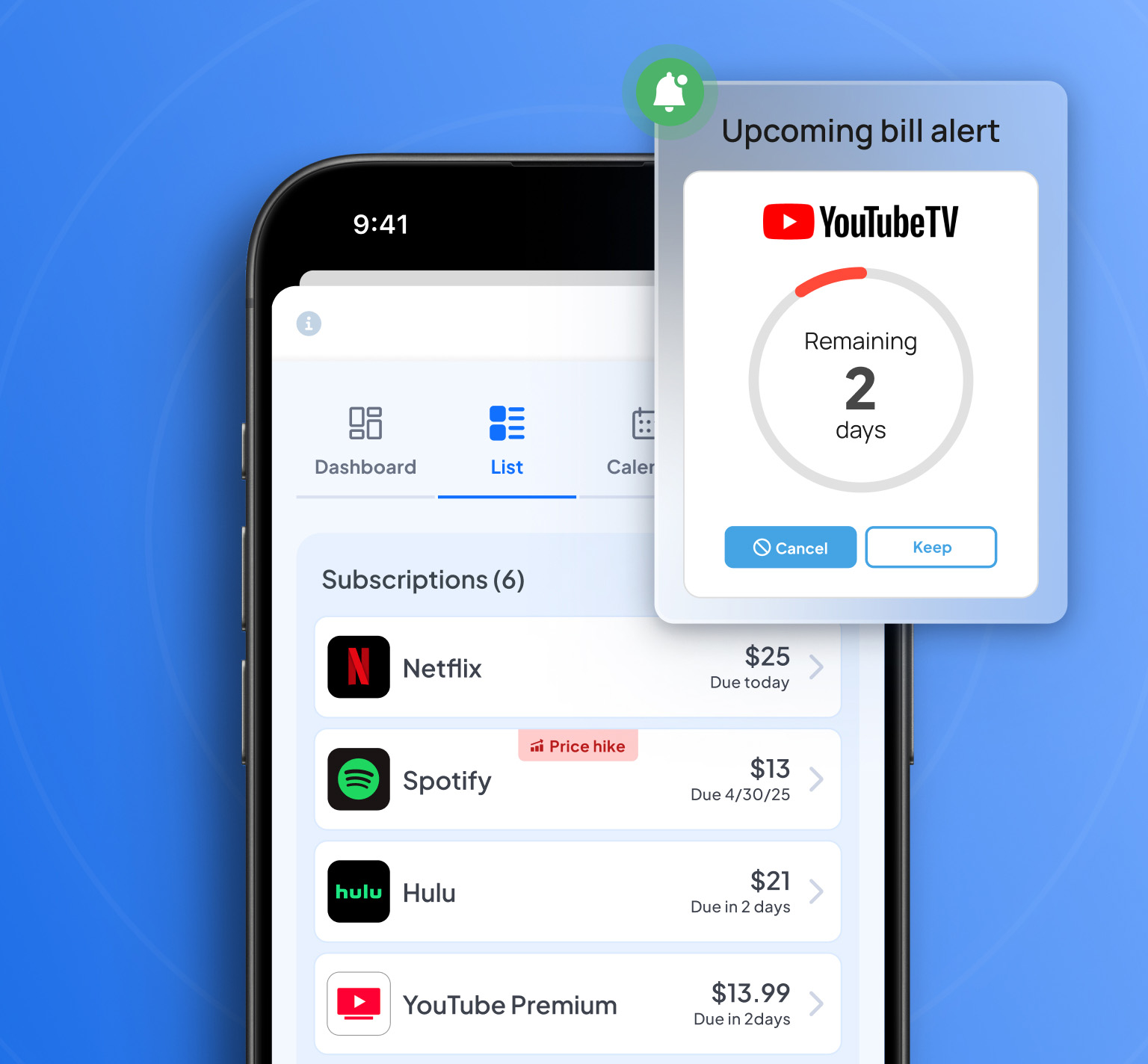

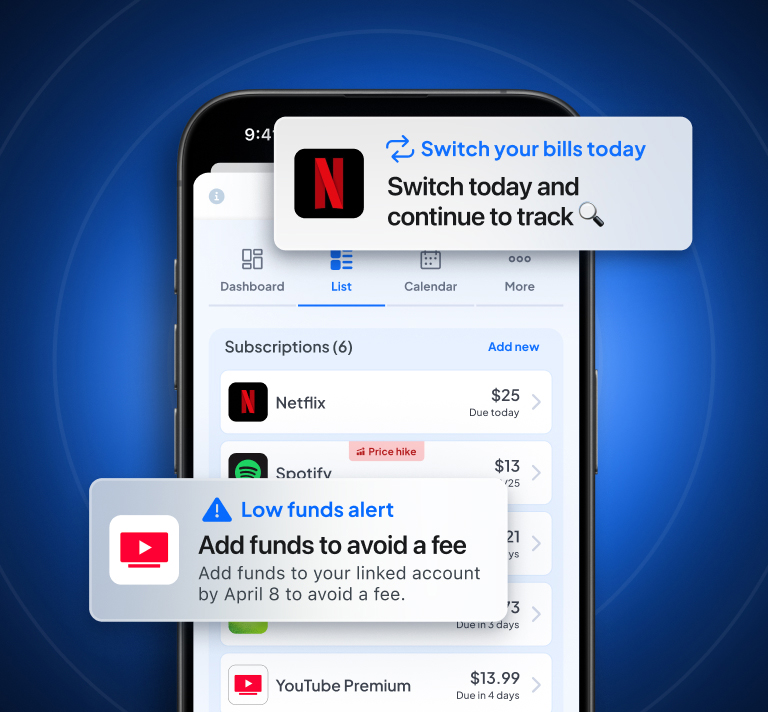

The API also uniquely enables recurring access to income and employment data, so lenders can keep track of any changes to the consumer’s financial picture.

Lastly, Pinwheel is the only payroll API provider that is a Consumer Reporting Agency (CRA). As a CRA, we can share consumer permissioned data while helping our clients stay Fair Credit Reporting Act (FCRA) compliant and avoid misusing consumers’ personal information.

Expedite the loan application process

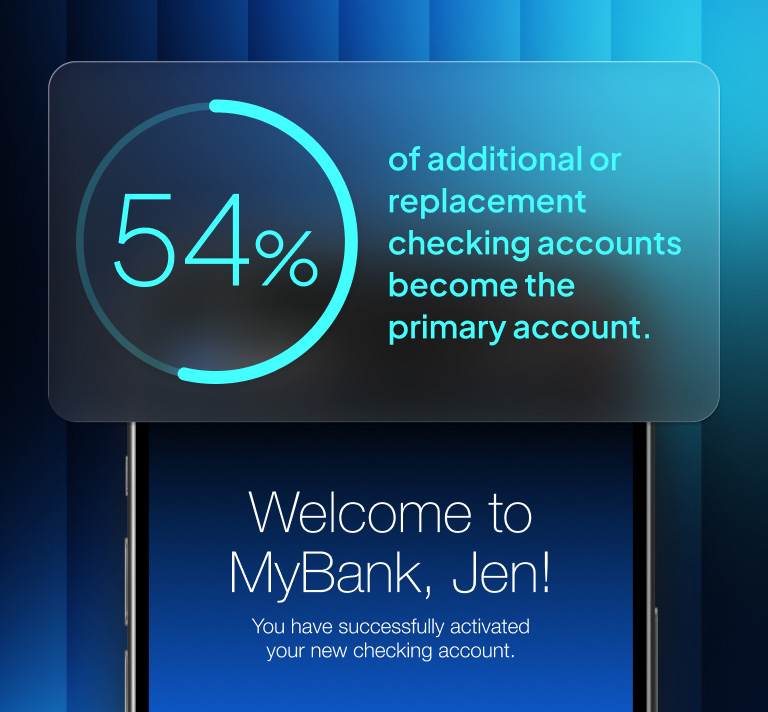

A payroll API makes it easy for lenders to offer a simple loan application process. Today, consumers have access to numerous convenient digital banking services. Saving, investing, buying cryptocurrency — all of this can be done with an app. But when applying for a loan, many customers still have to manually submit paperwork to verify their income and employment.

According to a recent ServiceLink State of Homebuying Report, 35% of homebuyers want less paperwork, and 33% don’t want to provide the same documentation multiple times. When homebuyers have access to a digital income verification solution, the process is much smoother — 83% of homebuyers report a “shorter than expected” loan processing time.

It goes without saying that income and employment data are sensitive. Even so, 88% of consumers are comfortable sharing their consumer permissioned data with lenders. As such, security must be a priority for payroll API providers. Pinwheel, for example, uses bank-level encryption and continuously monitors its systems for issues.

Improve tenant screening services

Payroll APIs can improve the screening process using accurate information directly from payroll and income platforms.

When screening potential tenants, landlords often rely on automated reports from third-party companies that gather data from credit bureaus and other databases tracking an individual's history. But these reports can be filled with errors, in addition to mixing up information on individuals who share the same name. How can landlords be confident they selected the right tenant using such unreliable information? Spoiler alert: They can't.

Fraud is another major concern of landlords. More than 300 websites offer to generate fake pay stubs for a nominal fee, and recognizing them can be difficult. Not to mention that it costs time to verify paystub authenticity.

Fortunately, payroll APIs take inaccurate and fraudulent information out of the equation. And proptech companies are already using them to simplify verification of income and employment to great success. All the applicant has to do is log into their payroll or income platform, and the API handles the rest behind the scenes.

Payroll APIs can transform traditional loan and rental application processes

APIs that pull employment and income data open doors to faster and more inclusive lending and renting.

Lenders can expand their client base to financially underserved consumers and offer products at better interest rates that render high-interest loans obsolete. 64% of Americans live paycheck to paycheck, and this group is vulnerable to payday loans when faced with an unexpected expense. Access to more affordable loans can prevent them from experiencing even greater financial difficulties down the line. If you help someone get on their feet financially today, you reap the long-term rewards of their success because they’re more likely to remain a client.

Meanwhile, property managers can quickly identify their ideal tenants using accurate information. Tedious paperwork and unverifiable income checks will no longer be necessary, and everyone involved will benefit from a quick screening process.

Most importantly, neither application process will have to rely solely on limited credit score data to determine consumers’ financial health.

.svg)

.svg)